After nine years, Wang Weiya still feels that he was late in venturing abroad.

In the business circles of Hanoi, Vietnam, Wang is affectionately known as “Old Wang.” There’s a saying that has become quite popular among local entrepreneurs: “When heading to Vietnam, follow Old Wang’s lead.”

As Wang Weiya himself puts it, he’s spent his life “swimming” in the capital markets. His career in securities began in Henan in 1996, witnessing the volatile shifts of the securities market, establishing his private equity firm, surviving market crashes, and finally deciding to go overseas. Wang is convinced that beneath Vietnam’s long coastline, the ubiquitous motorbike traffic, the leisurely tropical lifestyle, and its market of over 100 million people lies a capital market brimming with untapped potential.

When the Ho Chi Minh Index was launched in Vietnam at the turn of the millennium, it started at a baseline of 100 points. Today, it has soared more than tenfold, reaching 1,286 points. When Wang first arrived in Vietnam in 2015, the capital market there was still a vast, untamed wilderness. “It was challenging even to recruit securities professionals.” Yet, despite these early challenges, Wang still feels he was late to the game.

Before his arrival, several waves of Chinese manufacturing industries had already ventured into Vietnam, driven by policies like the Pearl River Delta’s “emptying the cage for new birds” strategy, favorable tariffs in Vietnam, and Chinese companies’ proactive “going global” initiatives. Against the backdrop of an accelerating restructuring of global supply chains, the trade symbiosis between China and Vietnam has only deepened.

Recently, Vietnamese President Vo Van Thuong visited China, with his first stop in Guangdong. According to the Vietnam News Agency, President Thuong suggested that Guangdong and Vietnam strengthen their economic and trade cooperation, encouraging Guangdong enterprises to expand high-quality investments in Vietnam, particularly in digital transformation, green growth, and infrastructure sectors.

Today, Vietnam is striving to push forward with economic reforms, aiming to replicate the economic boom that China experienced. “If you go to Vietnam, you’ll find that many places are reminiscent of the Pearl River Delta cities from ten or twenty years ago,” several overseas entrepreneurs told Southern Finance All Media reporters. If Vietnam has offered Chinese, especially Guangdong enterprises, a valuable opportunity to “go global,” then Wang Weiya and the pioneering entrepreneurs from the manufacturing sector are undoubtedly among the crucial players riding this wave of globalization.

Making Money Isn’t Easy

Wang Weiya hails from Henan. After leaving his hometown of Kaifeng, Henan, his career spanned across various domestic securities firms, making him one of the first in China to obtain a securities investment consulting qualification. When speaking with Wang and his peers, Southern Finance All Media reporters often heard phrases like “by chance, I came to Vietnam.”

But these so-called coincidences are underpinned by inevitability. “In 2015, the domestic stock market was turbulent, and many were ‘hurt.’ After discussing it with friends, I decided to look abroad,” Wang said. In his view, choosing Vietnam was straightforward: existing business ties, geographical proximity, and a significant demographic dividend.

When he first arrived in Vietnam, he was somewhat hesitant. Vietnam’s stock issuance system was different from China’s, and investors’ market awareness was relatively underdeveloped. While the barriers to entry seemed low, it was challenging to succeed. Doing finance here felt like “building a skyscraper on flat ground.”

However, looking back over the past nine years, Wang believes he made the right choice. At the age of 47, he came to Vietnam. The following year, he acquired a local securities firm, renaming it “Construction Securities.” This company later became one of the two Chinese-funded listed securities firms in Vietnam—the other being the long-established Guotai Junan Securities.

With his extensive industry experience and ownership of a listed company, Southern Finance All Media reporters posed a straightforward question to Wang: After nine years in Vietnam, did he make a lot of money?

After a moment’s reflection, Wang candidly replied that it wasn’t as easy as it seems.

Wang explained that listing a company in Vietnam is much less challenging than in China. Back then, with a registered capital equivalent to less than 10 million RMB, a company could reach the threshold for listing. However, even with the entity in place, navigating the path forward was anything but easy. The underdeveloped financial infrastructure in Vietnam was a significant hurdle, and the market’s understanding of securities was hard to improve, leaving the industry waiting for a breakthrough moment.

Initially, Construction Securities targeted clients across the Greater China region. However, when the pandemic hit, many business activities were disrupted. After adjusting to focus on local services, the firm introduced measures such as remote account opening. Although the number of clients increased, trading volumes remained stagnant. “In Vietnam’s securities ecosystem, it’s possible to sustain operations, but making big money is difficult,” Wang admitted.

In his view, to scale up, one must continuously increase investment, backed by strong capital, and steadily improve market share. This is why he expanded into the primary market in 2022, establishing Qilin Capital.

Wang is not alone in finding that “striking gold” in the South isn’t easy. As early as 2002, Chen Yongcong’s family-run joint venture, a factory producing industrial sewing thread in Dongguan, had already set up shop in Vietnam. Over the past 20 years, the Ho Chi Minh Index has soared more than tenfold. According to Chen, local workers’ wages have also increased more than tenfold.

Moreover, while labor costs in Vietnam remain lower than in China, worker efficiency is also relatively lower. This observation aligns with Wang’s. As global manufacturing companies increasingly set up factories in Vietnam, the local industry is accelerating its upgrade and transformation. However, the local workforce’s vocational training is relatively lacking, leaving much room for development in the labor market.

Over the past two decades, land costs in Vietnam have also been rising. Chen mentioned that the average rent for factory space in Ho Chi Minh City is now over $5 per square meter (equivalent to more than 35 RMB), which is even higher than in many parts of the Pearl River Delta. Currently, this industrial sewing thread company maintains a small office in Dongguan, while its factory is based in Vietnam. This aligns with Dongguan’s “dual transfer strategy” introduced in 2008. For manufacturing companies, even though “striking gold” isn’t easy and the cost of going abroad is rising, they must continue to expand internationally. Those that remain in China are striving to move up the “smiling curve” in the industry.

Vietnam’s “Golden Decade”

With costs no longer as low as before, what is attracting Chinese companies to Vietnam today?

On August 20, Dongguan DAYIN Plastic Products Co., Ltd. (referred to as “DAYIN Plastic”) officially opened its Vietnam branch. General Manager Wu Xianda and his team traveled to Vietnam for the ribbon-cutting ceremony. He told Southern Finance All Media reporters that the Vietnam branch was established quickly: site selection in January, contract signing in February, factory completion in half a year, and now the 10,000-square-meter factory in Bac Ninh, Vietnam, is hiring staff and ready to commence operations.

DAYIN Plastic is a Taiwanese enterprise. When it moved from Taiwan to Dongguan in 1997, it had only five injection molding machines. Over the past 20 years, the company has transformed into a significant player with over 600 employees, manufacturing products such as smart home appliances, sports products, and semi-finished goods for global brands.

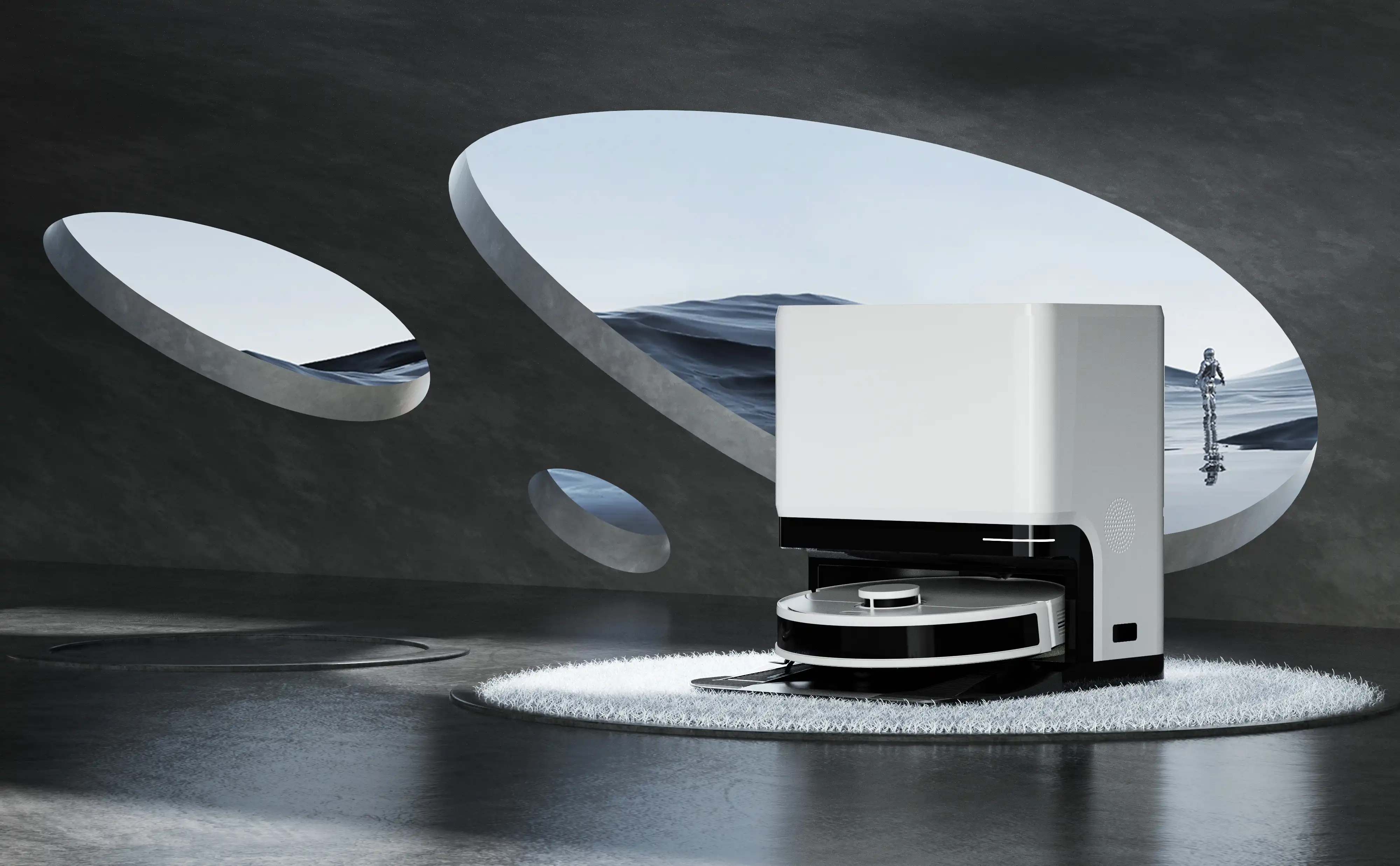

The rapid construction of the Vietnam factory reflects a sense of urgency. Robotic vacuum cleaners are a critical product line for DAYIN Plastic. The United States Trade Representative’s Office had previously announced that the tariff exemption on household appliances like vacuum cleaners, robotic vacuum cleaners, and air fryers would expire on June 14, 2024. After this date, these products would face a 25% tariff.

The increase in tariffs on some Chinese goods by the United States poses a significant challenge for DAYIN Plastic, which primarily exports to American and European customers. Additionally, the company’s revenue has declined over the past two years due to unstable global economic recovery, making it imperative to retain existing clients and actively seek new ones. “We have to go abroad,” Wu Xianda said.

Wu explained to Southern Finance All Media reporters that producing robotic vacuum cleaners in Vietnam is more expensive than in China. Firstly, compared to China, the savings in rent and labor costs are minimal. Secondly, Vietnam’s supply chain is not as developed as that in the Pearl River Delta. This means that additional costs for importing raw materials and transportation need to be factored into the cost structure. Therefore, DAYIN Plastic’s products exported from Vietnam are priced 5% to 10% higher than those exported from China.

After all the exploration, they still need to import components from the Pearl River Delta to their factory in Vietnam.

After exploring options like Mexico, the Philippines, Indonesia, and Thailand—locations that have become popular among Chinese enterprises setting up factories abroad in recent years—Wu Xianda and his team decided that none of them met their criteria. They sought a location close to China, with lower costs, friendly diplomatic relations, and a high degree of openness.

“There’s no place more suitable than Vietnam,” Wu said. Currently, Vietnam has signed 16 free trade agreements with countries and markets including ASEAN, the European Union, and the Americas, allowing it to benefit from preferential tariffs in over 60 countries/regions. Additionally, Bac Ninh in Vietnam is only about 900 kilometers away from Dongguan, and imported parts can be transported by road. “We import a lot of materials from the Pearl River Delta, so logistics costs are a crucial consideration.”

Wu Xianda, himself a “second-generation factory owner,” notes that DAYIN Plastic’s development is aligned with the restructuring of the global industrial and supply chains. The manufacturing base moved from Taiwan or Hong Kong to the Pearl River Delta, and then from the Pearl River Delta to western China or Vietnam. Today, when Chinese factories are established in Vietnam, it’s no longer just a simple transfer of production capacity; it’s about integrating into the local market, boosting local employment, and facilitating the import and export of intermediate goods between China and Vietnam.

Taking DAYIN Plastic as an example, Chinese companies setting up factories abroad often drive growth in the import and export of intermediate goods. China has long been Vietnam’s largest trading partner, the largest source of imports, and the second-largest export market. Vietnam, in turn, is China’s fourth-largest trading partner globally and the largest in ASEAN. Among Chinese provinces, Guangdong has the largest trade volume with Vietnam, accounting for about one-fifth of the total trade between the two countries.

In the first seven months of this year, Guangdong’s imports of electronic components and LCD flat panel display modules from Vietnam surged by 2,084.9% and 17,346.2%, respectively, while its exports of mechanical and electrical products to Vietnam reached 72.08 billion RMB, an increase of 34.2% year-on-year. Against the backdrop of a global recovery in the electronics and information industry, the relationship between China and Vietnam in the global supply chain is more complementary than substitutive, with cooperation between the two regions becoming increasingly prominent in the global supply chain.

“According to the flying geese model, it’s perfectly normal for companies to relocate. Whether they can succeed abroad depends on the market, the companies, and the consumers,” said Liu Ying, a researcher and director of the Cooperation Research Department at the Chongyang Institute for Financial Studies, Renmin University of China. She noted that the global industrial and supply chains are undergoing restructuring, with China playing a central role. China, together with ASEAN countries including Vietnam, is committed to promoting regional economic integration.

During the interview, Liu Ying had just returned from research trips to Malaysia and Thailand. She shared with Southern Finance All Media reporters her profound observation that for a long time, Chinese enterprises venturing abroad have done so in an unstructured manner. “We need a standardized approach to going global, ensuring both internationalization and localization are well-executed, and we must work with our trade partners to navigate the next golden decade of the Belt and Road Initiative.”

As Wang Weiya enters his tenth year overseas, he has noticed a significant shift in Chinese investments in Vietnam, expanding from real estate to manufacturing and now to new sectors. Financial services, healthcare, education, and retail are currently the most favored categories among Vietnamese local capital. The seasoned securities professional, Wang Weiya, having tested the waters of Vietnam’s capital market, humorously remarks that he plans to steadily build up his company and expects to “keep swimming” in the capital markets for the foreseeable future.